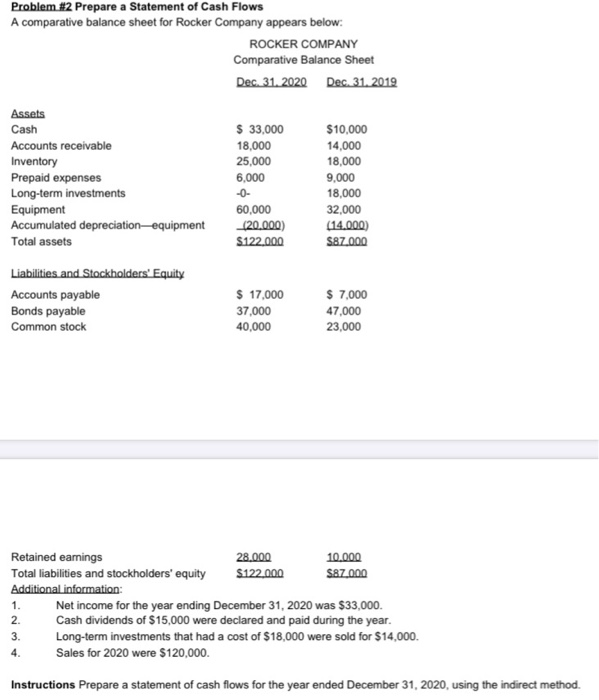

Under either method, the investing activities and financing sections are identical. The direct or indirect method may be utilized to prepare the cash flow statement.

#Cash flow statement depreciation full

Record cash changes related to investors, loans, or dividend payments made.Īdditionally, you may need to use notes or an attachment to disclose certain non-cash activities which are part of a full snapshot of the company's position, such as acquiring an asset by assuming a liability. Record cash changes in assets or equipment, or general monetary investments. Typically, this is the most telling category, since it shows whether the company's core business is generating enough cash for sustainability. Record cash expended and received from the company's main line of business. To create a cash flow statement, organize all cash transactions under the following three primary sections. The cash flow statement shows a company's ability to generate cash, which is crucial in understanding the profitability and viability of any company.Ĭomparing changes in cash flow from one period to the next sheds important information about the company's direction. A company with a profitable income statement but insufficient cash flows is not likely to be a profitable investment, as it will not have the necessary cash to continue operations.

This type of accounting gives a picture of a business's finances based on when activities are completed versus when cash outlays are made.

It presents a comprehensive picture of a company's strength and profitability, providing critical information for investors, creditors, and management.Ī cash flow statement is necessary because net income is typically viewed using accrual-based accounting.

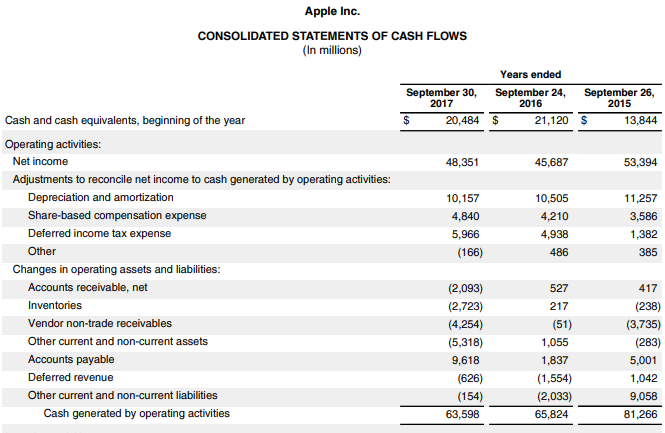

The cash flow statement, together with the income statement and balance sheet, is one of the key financial statements used to measure a company's position. It is an important measure of how a company generates and manages its cash, which translates into cash available to fund operations and pay debt. Examples of intangible assets include copyrights, patents, and trademarks.A cash flow statement is a financial statement that summarizes the cash flowing in and out of a company during a specified time period. For example, an asset worth $100,000 in year 1 may have a depreciation expense of $10,000, so it appears as an asset worth $90,000 in year 2.Īmortization is a similar process to deprecation but is the term used when applied to intangible assets. Depreciation expense does not require a current outlay of cash, but the cost of acquiring assets does. In each period, long-term non-cash assets accrue a depreciation expense that appears on the income statement.

The former affects values of businesses and entities. On a more detailed level, depreciation refers to two very different but related concepts: the decrease in the value of tangible assets (fair value depreciation) and the allocation of the cost of tangible assets to periods in which they are used (depreciation with the matching principle). A machine bought in 2012, for example, will not be worth the same amount in 2022 because of things like wear-and-tear and obsolescence. Machinery: Machinery is an example of a non-cash asset.īroadly speaking, depreciation is a way of accounting for the decreasing value of long-term assets over time.

0 kommentar(er)

0 kommentar(er)